City Of Wheat Ridge Co Sales Tax License Renewal . Learn about the new state rules. the city of wheat ridge code of laws is available online. the current sales tax rate in wheat ridge, co is 8%. Required for all permanent businesses and anyone collecting sales. access the official website of wheat ridge, co to view your sales tax account history, file and pay a tax return, renew your. see below for how to renew or apply for a city of wheat ridge business license. how to file the colorado retail sales tax return (dr 0100) using revenue online for filing periods beginning on january 1, 2020. find out how to renew your business license and pay taxes online or by mail in wheat ridge, co. The sections pertinent to business licensing and city taxes are. there are two options for filing your taxes online. Click for sales tax rates, wheat ridge sales tax calculator, and printable sales.

from www.formsbank.com

the city of wheat ridge code of laws is available online. how to file the colorado retail sales tax return (dr 0100) using revenue online for filing periods beginning on january 1, 2020. there are two options for filing your taxes online. find out how to renew your business license and pay taxes online or by mail in wheat ridge, co. Required for all permanent businesses and anyone collecting sales. Click for sales tax rates, wheat ridge sales tax calculator, and printable sales. The sections pertinent to business licensing and city taxes are. see below for how to renew or apply for a city of wheat ridge business license. access the official website of wheat ridge, co to view your sales tax account history, file and pay a tax return, renew your. the current sales tax rate in wheat ridge, co is 8%.

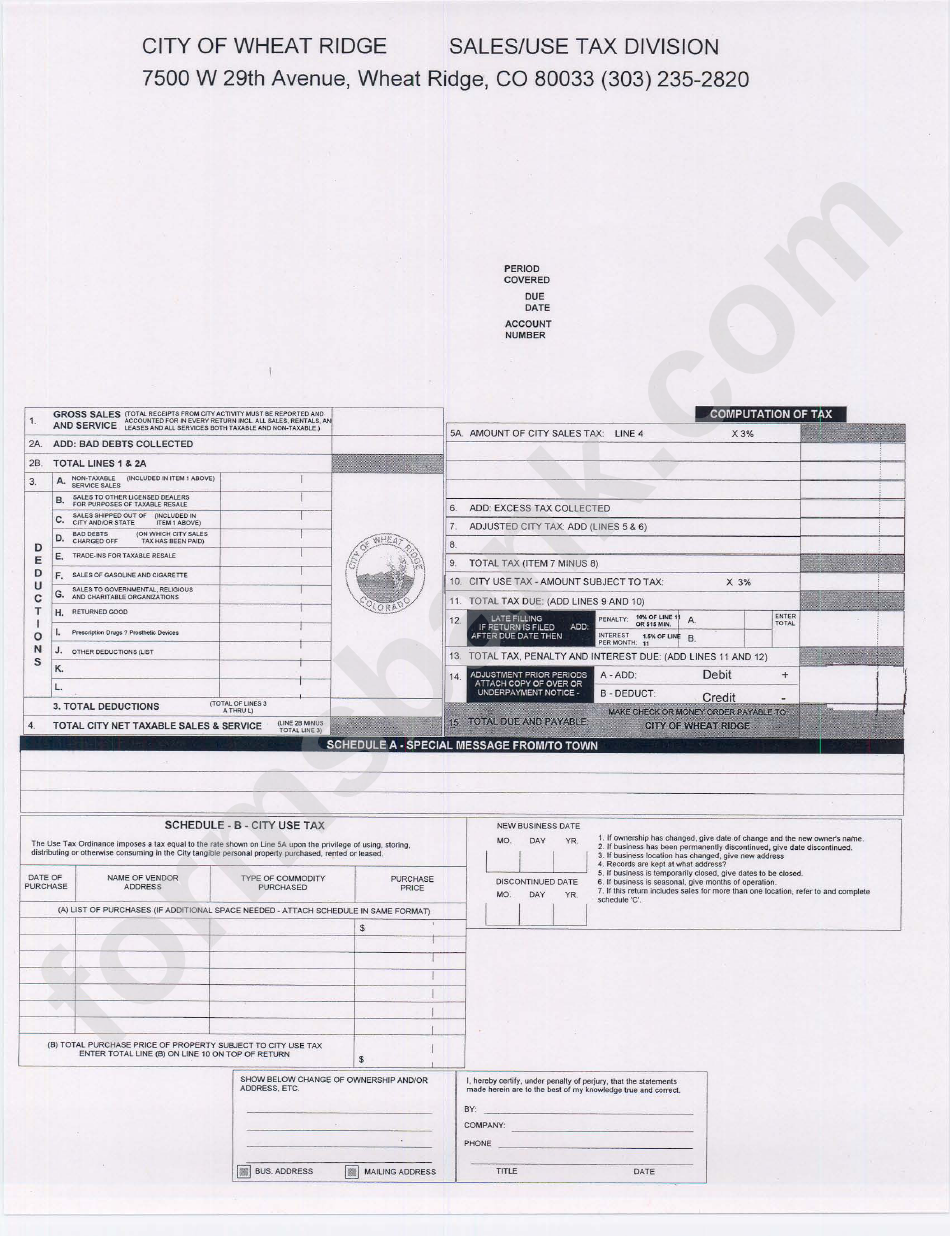

Schedule A & B Sales And Use Tax City Of Wheat Ridge, Colorado

City Of Wheat Ridge Co Sales Tax License Renewal Required for all permanent businesses and anyone collecting sales. the city of wheat ridge code of laws is available online. Learn about the new state rules. The sections pertinent to business licensing and city taxes are. how to file the colorado retail sales tax return (dr 0100) using revenue online for filing periods beginning on january 1, 2020. the current sales tax rate in wheat ridge, co is 8%. Required for all permanent businesses and anyone collecting sales. find out how to renew your business license and pay taxes online or by mail in wheat ridge, co. there are two options for filing your taxes online. see below for how to renew or apply for a city of wheat ridge business license. access the official website of wheat ridge, co to view your sales tax account history, file and pay a tax return, renew your. Click for sales tax rates, wheat ridge sales tax calculator, and printable sales.

From www.formsbank.com

Sales Tax Form License And License Renewal Application Town Of City Of Wheat Ridge Co Sales Tax License Renewal Required for all permanent businesses and anyone collecting sales. The sections pertinent to business licensing and city taxes are. see below for how to renew or apply for a city of wheat ridge business license. find out how to renew your business license and pay taxes online or by mail in wheat ridge, co. access the official. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.ci.wheatridge.co.us

Wheat Ridge, CO Official site Official site City Of Wheat Ridge Co Sales Tax License Renewal see below for how to renew or apply for a city of wheat ridge business license. the city of wheat ridge code of laws is available online. how to file the colorado retail sales tax return (dr 0100) using revenue online for filing periods beginning on january 1, 2020. The sections pertinent to business licensing and city. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.formsbank.com

City Of Wheat Ridge, Colorado printable pdf download City Of Wheat Ridge Co Sales Tax License Renewal see below for how to renew or apply for a city of wheat ridge business license. the current sales tax rate in wheat ridge, co is 8%. access the official website of wheat ridge, co to view your sales tax account history, file and pay a tax return, renew your. how to file the colorado retail. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.formsbank.com

City Of Wheat Ridge, Colorado printable pdf download City Of Wheat Ridge Co Sales Tax License Renewal the current sales tax rate in wheat ridge, co is 8%. how to file the colorado retail sales tax return (dr 0100) using revenue online for filing periods beginning on january 1, 2020. Learn about the new state rules. Required for all permanent businesses and anyone collecting sales. there are two options for filing your taxes online.. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.templateroller.com

City of Wheat Ridge, Colorado Business and Tax License Application City Of Wheat Ridge Co Sales Tax License Renewal The sections pertinent to business licensing and city taxes are. Click for sales tax rates, wheat ridge sales tax calculator, and printable sales. Required for all permanent businesses and anyone collecting sales. access the official website of wheat ridge, co to view your sales tax account history, file and pay a tax return, renew your. there are two. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.ci.wheatridge.co.us

Tax & Licensing Wheat Ridge, CO Official site City Of Wheat Ridge Co Sales Tax License Renewal the current sales tax rate in wheat ridge, co is 8%. Click for sales tax rates, wheat ridge sales tax calculator, and printable sales. there are two options for filing your taxes online. access the official website of wheat ridge, co to view your sales tax account history, file and pay a tax return, renew your. . City Of Wheat Ridge Co Sales Tax License Renewal.

From www.templateroller.com

Form 0594 Fill Out, Sign Online and Download Printable PDF, Colorado City Of Wheat Ridge Co Sales Tax License Renewal Learn about the new state rules. see below for how to renew or apply for a city of wheat ridge business license. the city of wheat ridge code of laws is available online. The sections pertinent to business licensing and city taxes are. find out how to renew your business license and pay taxes online or by. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.formsbank.com

Gross Sales And Service Form City Of Wheat Ridge printable pdf download City Of Wheat Ridge Co Sales Tax License Renewal Learn about the new state rules. access the official website of wheat ridge, co to view your sales tax account history, file and pay a tax return, renew your. the current sales tax rate in wheat ridge, co is 8%. how to file the colorado retail sales tax return (dr 0100) using revenue online for filing periods. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.thestone.com

Wheat Ridge The Stone City Of Wheat Ridge Co Sales Tax License Renewal Click for sales tax rates, wheat ridge sales tax calculator, and printable sales. how to file the colorado retail sales tax return (dr 0100) using revenue online for filing periods beginning on january 1, 2020. there are two options for filing your taxes online. see below for how to renew or apply for a city of wheat. City Of Wheat Ridge Co Sales Tax License Renewal.

From nextdoor.com

The City of Wheat Ridge is excited to announce that the city's website City Of Wheat Ridge Co Sales Tax License Renewal see below for how to renew or apply for a city of wheat ridge business license. Required for all permanent businesses and anyone collecting sales. access the official website of wheat ridge, co to view your sales tax account history, file and pay a tax return, renew your. the city of wheat ridge code of laws is. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.ci.wheatridge.co.us

Permits & Licensing Wheat Ridge, CO Official site City Of Wheat Ridge Co Sales Tax License Renewal see below for how to renew or apply for a city of wheat ridge business license. there are two options for filing your taxes online. the current sales tax rate in wheat ridge, co is 8%. the city of wheat ridge code of laws is available online. access the official website of wheat ridge, co. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.templateroller.com

Form DR0594 Fill Out, Sign Online and Download Fillable PDF, Colorado City Of Wheat Ridge Co Sales Tax License Renewal Learn about the new state rules. find out how to renew your business license and pay taxes online or by mail in wheat ridge, co. Required for all permanent businesses and anyone collecting sales. Click for sales tax rates, wheat ridge sales tax calculator, and printable sales. how to file the colorado retail sales tax return (dr 0100). City Of Wheat Ridge Co Sales Tax License Renewal.

From www.templateroller.com

City of Wheat Ridge, Colorado Business and Tax License Application City Of Wheat Ridge Co Sales Tax License Renewal the current sales tax rate in wheat ridge, co is 8%. Click for sales tax rates, wheat ridge sales tax calculator, and printable sales. Required for all permanent businesses and anyone collecting sales. The sections pertinent to business licensing and city taxes are. there are two options for filing your taxes online. see below for how to. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.argis.com

The City of Wheat Ridge, CO Updates its GIS Infrastructure — Argis City Of Wheat Ridge Co Sales Tax License Renewal access the official website of wheat ridge, co to view your sales tax account history, file and pay a tax return, renew your. Learn about the new state rules. the current sales tax rate in wheat ridge, co is 8%. find out how to renew your business license and pay taxes online or by mail in wheat. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.templateroller.com

Form DR0593 Fill Out, Sign Online and Download Fillable PDF, Colorado City Of Wheat Ridge Co Sales Tax License Renewal the current sales tax rate in wheat ridge, co is 8%. Click for sales tax rates, wheat ridge sales tax calculator, and printable sales. Required for all permanent businesses and anyone collecting sales. the city of wheat ridge code of laws is available online. The sections pertinent to business licensing and city taxes are. find out how. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.ci.wheatridge.co.us

District Map Wheat Ridge, CO Official site City Of Wheat Ridge Co Sales Tax License Renewal how to file the colorado retail sales tax return (dr 0100) using revenue online for filing periods beginning on january 1, 2020. the city of wheat ridge code of laws is available online. the current sales tax rate in wheat ridge, co is 8%. Required for all permanent businesses and anyone collecting sales. Click for sales tax. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.templateroller.com

City of Wheat Ridge, Colorado Business and Tax License Application City Of Wheat Ridge Co Sales Tax License Renewal how to file the colorado retail sales tax return (dr 0100) using revenue online for filing periods beginning on january 1, 2020. access the official website of wheat ridge, co to view your sales tax account history, file and pay a tax return, renew your. find out how to renew your business license and pay taxes online. City Of Wheat Ridge Co Sales Tax License Renewal.

From www.formsbank.com

Schedule A & B Sales And Use Tax City Of Wheat Ridge, Colorado City Of Wheat Ridge Co Sales Tax License Renewal there are two options for filing your taxes online. Click for sales tax rates, wheat ridge sales tax calculator, and printable sales. the current sales tax rate in wheat ridge, co is 8%. find out how to renew your business license and pay taxes online or by mail in wheat ridge, co. Learn about the new state. City Of Wheat Ridge Co Sales Tax License Renewal.